Abstract

Since 2004, the oil prices have shown a predilection towards volatility and unpredictability. Starting with a decent $30/bbl in the first quarter of 2004, the oil prices skyrocketed to $132/bbl by July 2008. However, startlingly, in December 2008, the oil prices plummeted back to $50/bbl. This continual trend towards volatility could have a debilitating impact on the oil-consuming countries throughout the world. This situation is further aggravated by the fact that the oil production has remained practically static since 2004 despite a potential increase in demand. It is difficult to say whether this volatility will continue through 2009 or the things will revert back to the placid levels of 1986-2003 periods. The governments and financial institutions around the world are trying hard to come out with the instruments and the devices to control the risks imposed by the oil price volatility in the contemporary scenario. In that context, derivates could play a pivotal role in insulating the economies against oil price fluctuations. This paper intends to elaborate on how the oil price risks can be managed with derivatives.

Table of Contents

- I. Introduction

- II. Literature Review

- III. Using Models to Determine Oil Price Volatility

- Iv. The Factors Influencing Derivatives Markets

- V. Various Types of Derivatives Instruments

- Vi. Hedging with Forwards, Futures, Options and Swaps

- Vii. Conclusion

- Viii. Recommendations

- Bibliography

Figures

Figure

1.0 World Oil Consumption by Region, 1970-2020

2.0 Increments in Oil Consumption by Region, 1970-2020

3.0 OPEC Oil Production 1973-2007

Abbreviations

CFTC Commodities Futures Trading Commission

GAO United States Government Accountability Office

IEA International Energy Agency

ICE International Exchange

NYMEX New York Mercantile Exchange

OPEC Organization of the Petroleum Exporting Countries

OTC Over-the-Counter

WTO World Trade Organization

Section I

Introduction

In the 21st century, oil prices are once again exhibiting an increased trend towards volatility since the last noticeable price hikes in the 70s and the 80s. There is no denying the fact that oil prices tend to be more volatile then any other commodity and thus could have a considerable impact on the economy of a nation. Therefore, the developed and the developing countries are desperately resorting to all the strategies at their disposal, be it the price smoothing schemes, encouraging diversification, price control or fuel tax manipulations to tame the volatile oil prices (Bacon & Kojimi 2008). Certainly, the oil does not happen to be the only commodity that is vulnerable to price volatility, still the governments tend to take the oil price volatility quiet seriously owing to the pivotal role it plays in the national economies (Bacon & Kojimi 2008). Oil price volatility not only influences the transport sector, but also has a direct impact on the freight transport and the passenger transport (Bacon & Kojimi 2008). A thorough examination of the commodity prices by Regnier (2007) between 1945 and 2005 led to the conclusion that the prices of crude oil and oil products were much more volatile then any other commodity sold in the US. According to Regnier, oil prices happened to be more volatile then the prices of the 95 percent of the commodities sold in the US and the prices of the 60 percent of the primary commodities traded in America (2007).

In the last eight years, the oil prices have exhibited a more then average predilection for volatility. Oil prices, which in the year 2001 stood at a humble $19.39 per barrel, touched a peak of $95.39 per barrel by the start of 2008. As per the recent predictions of the International Energy Agency (IEA), though the oil prices are expected to relatively stabilize with the onset of a possible recovery from the ongoing recession, the world will have to bear with the oil prices volatility for a long time to come (Asia Plus News 2009). This augmented volatility in the oil prices in the last few years is quiet unlike the minor fluctuations witnessed in the oil prices throughout the 90s (Bacon and Kojimi 2009). This has motivated the governments and the financial institutions to exhibit an unprecedented heightened interest in the management of oil prices. Oil price volatility is a factor that is primarily defined by big and fast variations in the oil prices. This poses a difficult challenge to the governments in the sense that bigger and faster variations in the oil prices make it utterly difficult for them to wrought out the commensurate adjustments in the national economies, which severely jeopardizes their stability and growth. Thus an effective management of the oil price risks is a central issue for all the countries.

Effects of Oil Price Volatility

All the governments in general and those of the developing nations in particular find the responsibility of dealing with oil price volatility a real enervating task. This is basically because oil price volatility does often have a debilitating and severe impact on the economies. Oil price fluctuations impact an economy in a variety of ways. While some of the effects are all encompassing and broad based, there are other effects which destabilize the governments and thus indirectly jeopardize the economies. It goes without saying that oil price fluctuations do have a direct impact on the consumers and corporate firms. Some of the effects of the oil price volatility are:

Balance of Payments

The import bills definitely tend to appreciate in case of skyrocketing oil prices. This may negatively impact the balance of payments situation of a country (Bacon & Kojimi 2008). Mostly governments try to tackle such situations by opting for currency appreciation (Bacon & Kojimi 2008). However, such measures also simultaneously increase the price of the export commodities also. Governments do often manage to tackle the adverse balance of payments situations with currency reserves or borrowings, but these happen to be short term remedies (Bacon & Kojimi 2008). In fact many of the countries failed to rescue their economies by resorting to such measures in the face of the continual oil prices volatility as being witnessed since 2004 (Bacon & Kojimi 2008). Thus many of the governments were forced to restrain the rates of economic growth to reduce their import bills (Bacon & Kojimi 2008). In such circumstances defined by high oil price volatility, it gets really difficult for the governments to detect whether such fluctuations happen to be temporary or long term. This drastically compromises the effectiveness and efficacy of the countermeasures initiated by the governments (Bacon & Kojimi 2008). Oil price volatility gives way to fluid and unpredictable circumstances that mar any possibility of a planned growth and sustainability.

National Budgets

Planned budgets do play a central role in the economic growth of all the nations. The role of effective and growth-oriented budgets becomes more imperative in the case of developing economies. Hence, one major problem with the oil price volatility is that it immediately and irrevocably gets translated into a marked volatility in the governments’ spending schemes (Bacon & Kojimi 2008). High oil price volatility gives way to a situation of uncertainty and chaos at an international and local level. Governments find it difficult to discern whether the confusion unleashed by oil price volatility is permanent or temporary (Bacon & Kojimi 2008). It goes without saying that all the countries plan their budgets in advance by estimating the oil prices in the future (Bacon & Kojimi 2008). High oil price volatility eats into the relevance of such planning and impedes the economic growth. Hence the governments need to resort to novel financial instruments and devices like the derivatives to cover the risks imposed by oil price volatility. In the existing scenario, food and oil price volatility and climatic changes are colluding with the global slump to plummet the growth of the emerging economies like India and China (Aljazeera 2009). Countries like India had long time back opted for using derivatives to stabilize the prices in the farming sector. The expertise gathered over the years could definitely shift to managing the risks imposed by oil prices through derivatives.

Domestic Economic Output

Many a leading study have time and again, conclusively established the correlation existing between the volatile oil prices and low domestic outputs (Bacon & Kojimi 2009). A variety of reasons are responsible for this phenomenon. Volatile oil prices suck out the initiative out of corporate ventures. The companies get slothful in a market defined by fluctuating oil prices and do resort to a policy of wait and watch before committing themselves to tangible investment decision and commensurate budgetary allocations (Bacon & Kojimi 2008). Under such circumstances, the economies witness a marked shift of resources and investments to those sectors which do not use much oil and are thus discernibly insulated against a direct impact of the oil price fluctuations (Bacon & Kojimi 2008). In the developing nations, this gives way to a pathetic economic situation defined by high unemployment. In such countries, the labour employed in the oil intensive sectors usually lacks the skills, initiative and resources to facilitate a possible migration to other sectors (Bacon & Kojimi 2008). Also, rampant oil price fluctuations do necessitate a continual adjustment in prices and output targets that inevitably lead to the accrual of adjustment costs (Bacon & Kojimi 2008). This inhibits the optimal utilization of human and natural resources. Developing countries also lack the possible substitutes to oil and are obviously deficient in the less oil intensive technologies, which may make possible to escape the total brunt of the situations marked by volatile oil prices as witnessed in the last four years.

Direct Human Impact

It has been found that the people affiliated to the poorer sections of the society are the one who are often worst hit by the volatile oil prices (Bacon & Kojimi 2008). People mostly respond to oil price fluctuations by compromising on their levels of consumption (Bacon & Kojimi 2008). Further, an unhealthy impact of the oil prices in the form of costly imports and rising freight charges gives way to a high inflation rate. This further intensifies the compensatory instinct of the people. Developed nations like the US and UK have high welfare oriented budgetary allocations and at least the well to do people there have a relatively easy access to credit and borrowing facilities, which dilutes a possible pressure on their consumption expenditure and patterns owing to volatile oil prices (Bacon & Kojimi). In contrast, the lowest income groups in the developed and the developing nations being devoid of such facilities are the worst hit. This stratum of the society despite having a miniscule share in the national oil consumption is the one that is worst hit by the oil price volatility. The oil price volatility has a direct negative impact on the levels of nutrition and the quality of life of the poorest of the poor. This definitely destabilizes the society and inevitably may lead to political instability in a nation.

Government Response

Softening the impact of oil price fluctuations, calls for a lot of tight rope walking on the part of the governments. Many a third world nations try to cushion the adverse effects of the oil price fluctuations by resorting to international borrowings (Bacon & Kojimi 2008). Though such a strategy may seem effective in the short run, it is bound to have a burdening impact on the masses in the long run. Also a situation defined by volatile oil prices is inevitably accompanied by a more or less proportionate volatility in other sectors (Bacon & Kojimi 2008). Hence, any move made by a government that is solely focused on the oil prices may not prove to be real effective and holistic (Bacon Kojimi 2008). Resorting to oil subsidies is one other strategy that is very popular with the governments facing a volatile oil price situation. However, this leavens the fiscal deficit and restricts a government’s ability to spend on infrastructure, education, welfare and health and poverty elevation programs. Its is the high time when the nations should focus on valid financial instruments and devices that do not defy the ethos of free trade and free market and still provide a more stable and dependable solution to oil price risks.

Reasons for Volatile Oil Prices

Volatile oil prices can be attributed to a variety of reasons. Some of the salient factors responsible for volatile oil prices are:

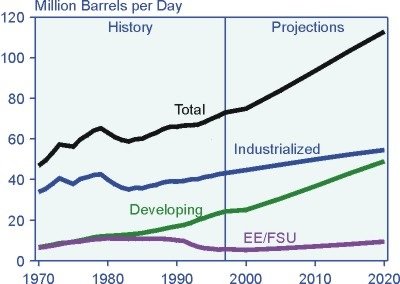

Expansion of World’s Oil Demand

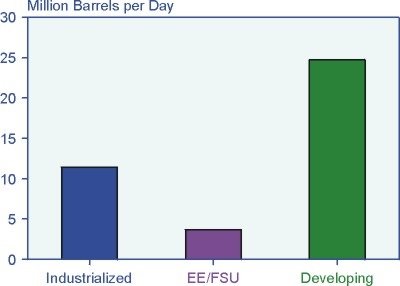

Oil happens to be the most sought after energy resource in the world that commands a more then 35 percent share in the total energy consumption throughout the world. Petroleum is used for a variety of reasons like transportation and as an industrial input. The total consumption of oil in the world is expected to increase at a rate of 1.9 percent per year (International Energy Outlook 2000). Even if one goes by the most conservative estimates, the worldwide consumption of oil that stood at 73 million barrels/day is expected to rise exponentially to a figure of 112.8 million barrels/day by the year 2020 (International Energy Outlook 2000).

The developed world happens to be the biggest consumer of oil and this trend is expected to remain so till 2020 (International Energy Outlook 2000). The total consumption of oil in the industrialized world, which stood at 43.1 million barrels/day in 1997, is being expected to augment to 54.5 million barrels/ day by 2020 (International Energy Outlook 2000). However, it is the developing countries which are projected to make a major contribution to an increase in the consumption of oil in the long run. As per some estimates, the share of the developing world in the total growth in the worldwide consumption of oil over the next decade is expected to be 62 percent (International Energy Outlook 2000).

Figure 1. World Oil Consumption by Region, 1970-2020

(International Energy Outlook 2000)

In the last two decades, the fast developing economies of Asia and Latin America witnessed a considerable increase in their oil consumption. This trend is expected to accelerate in the coming years. The industrially vibrant economies of Central and South America, Africa and Asia are projected to require more oil to sustain their rapid economic growth.

Figure 2. Increments in Oil Consumption by Region, 1997-2020

(International Energy Outlook 2000)

This existing and projected expansion of the overall world oil demand and the coveted status that oil commands as a driver of industrialization and growth has considerably contributed to the volatility of the oil prices since the advent of globalization.

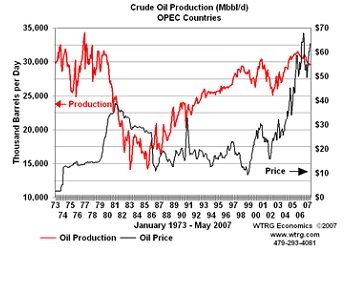

Rigid Crude Oil Supply

Contrary to an unprecedented increase in the demand for crude oil, the supply of crude has remained more or less rigid since the beginning of the 21st century. On March 31, 2004, the OPEC ministers began a systematic strangulation of the crude oil supply by announcing a 4 percent cut in production (National Petroleum News 2004). Despite the concerted efforts made by the pressure groups hailing from the developed and the developing countries, OPEC has till date refused to agree to an increase in the production of petroleum (National Petroleum News 2004). Taking excuse of the current economic meltdown and a resultant fall in the demand for oil, OPEC officials proposed further cuts in the production of crude oil in the first quarter of 2009 (Neil 2008). The proposed cuts are expected to stand around two million barrels per day (Neil 2004). There is no denying the fact that despite an overall expansion of the global oil consumption, the supply of crude has remained more or less rigid owing to many political and economic reasons, which has immensely added to the volatility of oil prices.

Figure 3. OPEC Oil Production 1973-2007

(WTRG Economics 2007)

Inventory Management by Oil Companies

Oil companies do play an important role in the petroleum sector in today’s globalized economies. Alteration in the inventory management practices by the oil companies is one other interesting factor that is contributing to the volatility of the oil prices (Bassam 2005). In the ongoing global recession, the oil companies are more then ever under pressure to please the shareholders by cutting costs. Hence they are increasingly shifting to just-in-time inventory policies (Bassam 2005). As a result of this new trend oil companies tend to rely more on OPEC holdings and spot market to ensure timely deliveries (Bassam 2005). This decline in the inventory holdings of oil companies means that any future fluctuation in demand happens to be dependent on the fluctuations in the crude oil prices rather then being met by making any alterations in the inventory levels (Pindyck 2001). The governments and financial institutions needs to be more cognizant of this aspect of the oil price volatility and must seek to exploit the related instruments and devices like the derivatives to manage oil price risks.

Growing Importance of Futures Markets

Every successive year, the role and importance of the future markets in setting the oil prices is on the rise (Bassam 2005). Since 1987, OPEC has developed its oil pricing strategy around a pricing formula that incorporates benchmarks such as Brent or WTI (Mabro 2001). Thus any volatility in these crude markers is bound to influence the volatility of the oil prices (Mabro 2001). One major lesson that the governments need to learn from this trend is that the volatility of the oil prices is not only influenced by the immediate fundamentals operating in the market, but also by the expectations pertaining to the supply and the demand of oil in the future (Bassam 2005). Ideally speaking, the future trends should be indicative of the possible allocation of the assets and investments in the times to come (Bassam 2005). However, since the last few years, the future markets are also being greatly influenced by political psychological factors (Bassam 2005). Thus, any pragmatic approach towards managing oil price risks needs to focus on the speculation and expectations about the oil prices in the future (Bassam 2005).

Unreliable Data

A transparent approach towards assessing the demand and supply of oil and the resultant prices does require ample reliable and prompt data. The data pertaining to the actual demand of oil, even in the developed countries is often vague, open to drastic revisions and published sporadically (Bassam 2005). This situation is further worsened by the emergence of the Asian giants like India and China, whose share in the total oil consumption though being significant, are not methodical in the collection and compilation of the related data. The same stands true in the case of the supply side. Manipulative national oil companies coming within the ambit of OPEC do add to the confusion pertaining to the actual production of oil (Bassam 2005). This situation is further aggravated by the emergence of many small oil producers in the market (Bassam 2005). The data pertaining to the inventory holdings of the international oil companies is often also less reliable and prone to revisions (Bassam 2005). In such a tight market as is prevalent since the past few years, any small discrepancy in the data related to the demand and the production of oil could unleash a spate of volatility. This may also cause the governments, oil companies and the oil producing nations to misjudge the market trends, thereby giving way to unwarranted price volatility (Bassam 2005).

Derivatives and Oil Price Risk

Definitions

Derivatives – “A derivative is a financial instrument whose value depends on the value of other, more basic underlying variables… Very often the variables underlying are the prices of traded assets… Derivatives can be dependent on almost any variable, from the price of hogs to the amount of snow falling at a certain ski resort (Hull 2001).”

Forwards, futures, options and swaps are some of the most common types of derivatives.

Forwards – “A forward is a particularly simple derivative. It is an agreement to buy or sell an asset at a certain future time for a certain price. A forward contract is traded in the over-the-counter market- usually between two financial institutions or between a financial institution and one of its clients (Hull 2001).”

Futures – “A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future for a certain price. Unlike forward contracts, futures contracts are normally traded on an exchange (Hull 2001).”

Options – “An option is a particular type of contract between two parties where one person gives the other person the right to buy or sell a specific asset at a specified price within a specific time period. In other words, the option is a specific derivative instrument under which one party gets the right, but no obligation, to buy or sell a specific quantity of an asset at an agreed price, on or before a particular date (Gupta 2009).”

Swaps – “Swaps are private agreements between the two parties to exchange cash flows in the future according to a prearranged formula. In simple words, a swap is an agreement to exchange payments of two different kinds in the future (Gupta 2009).”

In today’s globalized scenario, volatile oil prices have immensely added to the prevailing environment of uncertainty and the financial institutions and organizations around the world are seeking the methods and devices to manage the oil price risks. In the given context, derivatives can definitely be used by the nations to exercise oil price risk management. A planned and methodical economic growth all over the world requires a system that not only ascertains the genuine prices to the oil producers, but also guarantees a prompt supply of oil to the consumer nations at a reasonable and affordable price. Derivatives can certainly play a pivotal role in insulating the consumers and the producers of oil against volatile oil prices. According to Lokare,” Derivatives markets hold an immense potential for the economy as they stabilize the amplitude of price variations, facilitate lengthy, complex production decisions, bring a balance between demand and supply, act as a price barometer… (2007).”

Section II

Literature Review

A well organized and developed derivatives market can play a central role in stimulating the spot markets and encouraging a well diversified growth of the petroleum sector at a global level (Lokare 2007). In a post WTO scenario, marked by emerging challenges with regards to the volatile oil prices and a rigid oil supply, a derivative trading suggests a plausible way out. The governments are fast awakening to this option and are increasingly studying the benefits and risks involved in managing oil price volatility through spots and derivatives. Oil price volatility is the most urgent issue being faced by the oil consuming nations and oil intensive corporations all over the world. While negative fallout of this volatility is rampant in almost all the countries, its impact is more drastic in the case of the less developed countries (Lokare 2007). Considering the fact that the demand for oil is relatively price inelastic and is prone to shocks in terms of supply constraints, their definitely exists a problem of balancing the price with consumption for a majority of the less developed countries (Lokare 2007). The issue of managing the oil price risks has come to the centre stage of the commodity policy of many nations since 2004, going by the fact that their existed a negligible scope for exercising an influence over the supply.

The policies designed by the governments to contain oil price volatility have taken various forms since 2004; still most of them have incorporated the common feature of a direct government intervention (Lokare 2007). World oil supplies are prone to multiple risks like the tense political circumstances, a possible lowering of demand due to the current global recession and the proposed production cuts suggested by the OPEC. However, the most recent development has been that the governments are fast realizing the disadvantages and limitations of balancing oil prices through a direct intervention and are increasingly opting for managing the oil price instability by resorting to market solutions. “… Marked based risk management instruments, despite several limitations, offer a promising alternative to traditional stabilisation schemes (World Bank 1994).” Also considering the fact that a direct intervention by the governments makes them more vulnerable to the ensuing fiscal pressures, the nations are vying for a policy shift in the favour of a market oriented approach (Lokare 2007). A consensus is fast emerging at the global level that the directives markets could play an important role in the management of the oil price risks. By adopting a strategic stance in the directives markets, the oil consuming nations and the oil intensive corporate concerns can dilute the expected losses in the spot market. More over the direct intervention resorted to by the governments adds to the already existing subsidies being extended by them to the important sectors like farming and industry. Most of these governments are under obligation to the WTO to reduce their fiscal deficits and budgetary subsidies.

The American industry started dabbling in the derivatives in the later half of the 19th century. Initially the derivatives were primarily used to cover the risks involved in the foreign exchange transactions and bond markets (Pirog 2003). The use of derivatives to cover the price risks in the energy sector began with the introduction of heating oil futures contracts in the New York Mercantile Exchange (NYMEX) in 1978 (Pirog 2003). Since then, NYMEX has evolved to become a major portal for the trading in the energy derivatives in the US (Pirog 2003). The usage of derivatives to cover the oil price risks received a major boost with the establishment of International Petroleum Exchange in the UK in 1980 (Pirog 2003). With the establishment of NYMEX, the energy derivatives market expanded to include the commodities like gasoline, sour crude oil, sweet crude oil, natural gas and propane (Pirog 2003). Since then, the usage of derivatives to cover the oil price risks has become widespread and has in fact become an important aspect of the petroleum and the natural gas business.

Almost at the same time when the market for energy derivatives was expanding, the developed economies also saw the growth of over-the-counter derivative instruments. Most of the times, it were the leading financial institutions that acted as intermediaries in such contracts. The individual and oil intensive companies increasingly resorted to such market options to safeguard themselves against the oil price fluctuations and to arm themselves with the power to shift risks in precarious market situations. OTC contracts are today increasingly used by the financial institutions to cover the risks involved in the commodities markets. As per the figures provide by the Bank for International Settlements, worldwide, the value of OTC contracts in the year 2001 stood at $111 trillion (Pirog 2003). Out of this impressive figure, the contracts associated with the commodities alone commanded a value of $598 billion, that augmented to $777 billion by the second quarter of 2002 (Pirog 2003). In fact in the year 2001, the energy contracts worth $1.45 trillion were traded at NYMEX (Pirog 2003).

The market for the energy derivatives came under a cloud in 1993 because of the sudden eruption of several incidents of financial scandals and corporate bankruptcy (Pirog 2003). The derivatives were blamed for the demise of many established corporate concerns. In the year 1993, Orange County California went bankrupt owing to the massive losses amounting to $1.7 billion incurred in the derivatives trading (Pirog 2003). One other oil intensive MNC, Metallgesellschaft lost almost more then $1 billion in the energy derivatives in the US (Pirog 2003). In 1998, the Federal Reserve Bank of New York had to resort to a direct intervention in the crisis situation that engulfed the hedge fund, Long Term Capital Management, which traded in energy derivatives (Pirog 2003). The most recent case is that of the bankruptcy of Enron Corp., an energy company that increasingly resorted to derivatives to manage the risks posed by volatile oil and gas prices (Pirog 2003). Such debacles raised many disturbing questions as to whether derivatives can be used as instruments for managing oil price risks.

This row over the relevance of derivatives as an instrument for managing oil price risks has not subsided, but has gained a new dimension under the contemporary circumstances. Right from the start of 2002, the prices of natural gas, crude oil, unleaded gasoline and heating oil witnessed an exponential increase (Williams 2007). Though, many financial analysts and experts believe that this unprecedented spurt in the oil prices could be attributed to the normal functioning of demand and supply fundamentals. However, there exists another school of thought that blames a more then average futures trading to be really responsible for the currently volatile oil prices (Williams 2007). According to Orice M. Williams, the Director of Financial Markets and Community Investment, inflation-adjusted prices of oil in both the physical and futures markets skyrocketed by more then 200 percent in the period 2002-2006 (2007). During the same period, the volatility in the oil prices also remained at a more then average mark (Williams 2007). Though the specific impact of this volatility on the future oil prices and the global economy is yet not clear, still the voices are already being raised as to the culpability of the derivatives trading in these crises. Thus any attempt towards understanding the relevance of derivatives in managing oil price risks calls for a better understanding of the recent phenomenon.

The current volatility in the oil prices cannot be solely attributed to derivatives trading, but is the combined impact of multiple factors that influenced the derivatives and the futures markets (Williams 2007). In the period 2002-2006, the oil derivatives market evinced some peculiar developments. Some of the salient features of such developments were;

- The futures markets in the period under consideration witnessed very high oil prices most of the time. The spot price of oil in the given period increased by 200 percent, which was accompanied by an almost proportionate increase in the futures prices (Williams 2007). The price of the crude oil futures, which stood at a tolerable $22 per barrel in the start of 2002, augmented to $74 per barrel in the second quarter of 2006.

- The oil prices in the given period also exhibited a more then average volatility (Williams 2007). However, this rise in the degree of variability of the oil prices was not necessarily accompanied by an increase in the crude oil prices. In fact the prices of the crude oil subsided near the end of this period, though the volatility remained higher then the historical average (Williams 2007).

- One amazing thing that was observed in the given time period was that as the oil prises were soaring in the futures and physical markets, a large number of non-commercial traders like hedge funds entered the derivatives market (Williams 2007). The propitious trends in the global oil prices caught the attention and the interest of the non-commercial traders like hedge funds and they generously invested in the derivatives market, either to make a profit or to hedge against the ensuing changes (Williams 2007). As per the data furnished by CFTC, the number of non-commercial traders investing in the oil futures and options almost doubled in the given period (Williams 2007). The interest of the non-commercial traders in the derivatives market was particularly high in case of crude oil as compared to the other commodities.

- One another important aspect of the oil derivatives market in the period 2002-2006 was a marked appreciation in the trading volume of the oil futures contracts on NYMEX (Williams 2007). In fact the average daily contract volume augmented by 90 percent by 2006 (Williams 2007).

- This period also saw a significant increase in the volume of oil derivatives that were traded outside exchanges (Williams 2007). One particular aspect of the trading in such markets is that it often lacks transparency and it is relatively difficult to collect and process data about such transactions.

Various agencies and experts tend to analyze the above mentioned trends and factors in a variety of ways. Many market analysts believe that a hoarding of the oil derivatives by the speculators could have stimulated the projections about the demand of oil in the future that may have made the prices more volatile. However a respectable number of authentic federal agencies and market analysts were of the opinion that speculative activity did not contribute much to the volatility of the oil prices (Williams 2007). A study conducted by CFTC in 2005 in fact testified to these conclusions. Actually this study went ahead to the extent of claiming that the trading in the oil derivatives in the given period yielded the much needed liquidity to the market and had a restraining influence on the oil price volatility (Williams 2007). It makes sound common sense and financial dexterity to believe that mere speculative activity could not sustain oil price volatility over a long period of time, without supportive indications existing in the physical market. Eventually both the markets are governed by the information and projections pertaining to the demand and the supply of oil in the long run. The thing that needs to be kept in mind is that the digitalization of the economies in the last three decades has led to a close integration of the financial derivatives and the commodities markets. The primary purpose of evaluating this period marked by an unprecedented volatility in the oil prices is to clear all the misconceptions pertaining to the derivative markets as the precursors of volatility and to suggest the relevance of the derivatives as the potent instruments and tools to manage oil price risks. An analysis of the situation prevailing in the physical markets in the same time period will certainly yield a better insight into the salubrious possibilities inherent in the derivatives market.

There existed vivid and discernable factors in the physical markets, during the period 2002-2006 that contributed to the volatility in the derivatives markets. Futures prices are almost a reliable indicator of the expectations about the projected demand and supply of oil in the times to come and are certainly influenced by the related political developments and psychological factors (Williams 2007). For example, the conditions of political instability in the major oil producing countries could be interpreted as being indicative of a possible tight supply of oil in the future, which may make the derivatives and physical markets more volatile. In fact this close synchronization between the derivatives and the physical markets is really good and is the very reason that justifies the usage of derivatives to manage oil price risks. It is a known fact the supply of oil has been grossly outpaced by the expanding demand in the last three decades owing to the conditions of economic boom in the Asia and Latin America. The spare production capacity in the petroleum industry that could be used to cushion the price volatility in the tough times has gradually but definitely shrunk over time. Besides the supply of oil in the given time period was also restrained by important climatic and political factors like the hurricanes Katrina and Rita, political instability in some OPEC countries like Nigeria and Iraq and an adverse investment climate marring the oil sector in Russia (Williams 2007). The shrinking of the inventory holdings by the oil companies under the pressure of the recessionary trends has also made the oil prices more susceptible to the demand and supply fluctuations (Williams 2007).

Another important factor that impacted the volatility of the oil prices in the given period is the instability of the US dollar in the international currency markets (GAO 2006). The market for the crude oil is to a great extent vulnerable to the shifts in the value of the US dollar and the oil producing countries do prefer to receive the payments for their produce in the US dollar. Hence a weakening of the US dollar at any time would definitely depreciate the value of the crude oil at a given price. Thus the oil producing countries in their quest for maintaining a favourable balance of payments may be motivated to increase the prices of crude oil.

Considering the above mentioned factors that influence the physical markets, it would be totally wrong to attribute the contemporary oil price volatility to the activities in the derivatives markets. The need of the hour is that the governments and the financial institutions should realize the validity of the market based instruments in managing volatile oil prices and must increasingly resort to the exploitation of the derivatives contracts to stabilize the oil prices. This calls for a more organized, methodical and transparent functioning and monitoring of the derivatives markets. The governments should actively take the steps to discourage any impropriety in derivatives trading.

Oil price volatility challenges the fiscal stability of both the oil producing and oil consuming countries. Thus the government balance sheets around the world are vulnerable to oil price fluctuations. However, it is relatively easier for the oil exporting countries to insulate their fiscal policies against the oil price risks, as they exercise a direct control over the price and the supply of oil (Dominguez, Strong & Weiner 1989). Hence it is the consumer countries that are often more concerned about the oil price volatility. Thus, any stabilization policy for managing oil prices needs to focus on the task of limiting the vulnerability of economic growth and fiscal management to the oil price shocks and that too at a minimal cost and by exploiting all the available instruments and devices. At present the governments and the financial institutions prefer to resort to a variety of oil price risk management techniques like diversification, insurance and the establishment of stabilization funds. Derivates happen to be just one other market driven method at the disposal of the nations that can simply allow and enable them to transfer the risks imposed by the volatile oil prices to the markets. Many fast developing countries like China and India have come to realize with time that though the stabilization funds are certainly effective in ascertaining stable oil fiscal revenues, oil derivatives can definitely be tagged with the stabilization funds to manage oil price risks without incurring any incumbent immobility of the national resources.

Derivatives trading can certainly enhance the efficiency of any risk management strategy. With the adoption of the standardized rules and the setting up of the derivatives trading portals that are administered by appropriate procedures, it is really safe to use derivatives to tame the risks imposed by oil price volatility. Basic derivative instruments like forwards, futures, swaps and options can be exploited by the government agencies and the central banks to manage oil price risks (James 2003). The governments can opt to institutionalize the trading of energy derivatives by setting up hedging boards and hedging committees with well defined roles and accountabilities. These state institutions can be authorized to plan the hedging policies, revise and review the hedging strategies on a continual basis, forecast the oil prices, chalk out the appropriate strategies and guidelines and execute the hedging strategies.

The role of the futures markets has become central to the risk management in this age of volatility and unpredictability. Futures markets are certainly not the regular and the preferred way of procuring oil. Still, futures contracts can be tagged to the actual physical sale of oil to cover the unpredictability about the future oil prices. More and more countries are increasingly resorting to this option. The oil of the oil futures and the options contracts traded at the International Exchange (ICE) and the New York Mercantile Exchange (NYMEX) far exceeds the actual daily oil consumption of the oil (Bacon & Kojimi 2008). Certainly, a large number of such buyers are not directly associated with the consumption and production of oil, still a significant number of such buyers happen to be the actual consumers and the procurers of oil. Futures and options contracts enable a party to transfer the risk associated with the volatility of the oil prices to another party who is willing to bear that risk. In the last three decades, more and more countries and companies have chosen to hedge the oil prices. Chile decided in the favour of hedging its oil prices as far back as 1991, when the Gulf War began (Bacon & Kojimi 2008). Pakistan is already considering the possibility of hedging its oil prices so as to mange risks posed by the volatile oil prices to its constrained finances and revenues (Bacon & Kojimi 2008). The Ceylon Petroleum Corporation in Sri Lanka finalized its first oil hedging deal in 2007 (Bacon & Kojimi 2008).

Over the years, the derivatives markets all around the world have evolved to become more methodical, transparent and organized. There is no dearth of experts and institutions that are critically vociferous of the reliability of the derivatives contracts as an instrument of oil risk management. Yet, a careful analysis of the derivatives markets in the last three decades establishes beyond any doubt that primarily the derivatives markets chase the rampant trends in the physical markets, which furnishes a plausible mode for covering oil price risks. Any anomalies and discrepancies spotted in the derivatives markets owed their origin to a lax monitoring and management of the markets by the governments and the responsible institutions, which lead to the obfuscation of transparency and a lack of accountability. Considering the continually expanding demand for oil, a rigid oil supply, recession motivated changes in the inventory management practices of the oil companies and associated political, psychological and climatic factors, derivatives can safely be tagged to other modes of risk management like diversification, insurance and the stabilization funds to cover oil price risks. Besides the market oriented instruments of oil price risk management are more conducive for and acceptable to a post WTO world. A majority of the nations are increasingly adopting the derivatives oriented strategy of risk management and are moving ahead with the institutionalization of such practices.

Section III

Using Models To Determine Oil Price Volatility

The oil derivatives market is defined by a very high volatility in the current scenario. Yet, derivatives are increasingly being used by the nations and financial institutions to cover and transfer the risks imposed by volatile oil prices. Therefore, over the years, a whole range of mathematical instruments have been developed by the experts and the analysts to enable the end users to gauge the oil price volatility (Sharma 1998). These models incorporate various variables such as volume, price, delivery timing, point of delivery, etc. to furnish reliable volatility estimates (Sharma 1998). This allows the oil consumers to efficiently price the futures and options, so as to exploit them while managing risks imposed by volatile oil prices.

Volatility Models

Historical Volatility

As per the historical volatility model, if one assumes that ε t happens to be the innovation in mean so far as the energy price returns are concerned, then at a time t, a reliable estimate of volatility would be

N-1 ½

V H, t = [(1/N) Σ ε t- i]

. i=o

where N stands to be the forecast period (Sharma 1998). The historical volatility calculated as per this model is said to be “an N-day simple moving average volatility (Sharma 1998)”. The historical model tends to assume that the oil price volatility remained constant over the period for which the volatility is forecasted and calculated (Sharma 1998).

ARCH

Autoregressive Conditional Heteroscedasticity (ARCH) is a very important statistical instrument that can be used to analyse time varying volatility in the oil prices (Sharma 1998). The initial ARCH (q) model that Engle gave assumes that “the conditional variance h t to be a linear function of the first q put squared innovation (Sharma 1998).”

q

h t = ω + Σ α i ε² t-1

i=1

The peculiarity of this model is that it allows the conditional variance existing in the past to be immensely influenced by the square error time ensuing from any major market change in the past or the present (Sharma 1998). The difficulty with this model is that it requires a long time length q in most of its applications (Sharma 1998).

EGARCH

The Exponential Generalized Autoregressive Conditional Heteroscedasticity (EGARCH) model was given by Nelson (Sharma 1998). This model estimates the directional impact of changing oil prices on conditional variance (Sharma 1998).

1/2

1n (h t) = ω + ß 1 1n (h t-1) + θz t-1 + γ (׀1z t-1׀ – (2/Л)

The basic thing about all the mathematical models selected to estimate oil price volatility is that they point towards the parity existing between the spot and future prices, which is the quintessence of the law of one price that governs the derivatives markets. Since the last few decades, the commodity markets and particularly the oil markets have been real volatile. This high volatility governing the oil prices has necessitated the relevance of hedging as a risk management tool. There exist primarily two types of models that are employed for estimating oil price volatility. One is the “forward looking initial volatility measures (Sharma 1998)” and the other is the “backward looking time series measures (Sharma 1998)”. Each model has its own peculiarities, assumptions and the accuracy of forecast. The concerned parties can exploit the available models either alone or in a combination to calculate the variability and volatility of derivatives and oil prices by incorporating the available historical data and statistics. The global and institutional interest in the oil price volatility and its impact on the derivatives markets has augmented with time, courtesy the strategic role that the oil plays in the fiscal and growth policies of the impacted nations.

The basic issues that most of the mathematical models associated with the oil price volatility try to address are:

- “Is there a trend or pattern in the development of oil prices over time, or are they random (Bacon & Kojimi 2008)?”

- “How much variability is there around any trend in prices that can be identified, and has the variability changed over time (Bacon and Kojimi 2008)?”

- “Is the variability similar for series measured over different time intervals (daily, weekly, monthly), for prices expressed in nominal or real terms, and for prices of crude oil and different oil products (Bacon & Kojimi)?”

- “In non US markets, how does the variability of oil and oil product prices behave in local currency terms (Bacon & Kojimi)?”

As is with the other commodities, the statistical nature of oil and oil prices has been the center of interest of the central banks and financial institutions. A plausible statistical analysis of the oil prices relies on the fact that whether the oil prices are stationary or not.

“If the mean and variance of a series remain constant as more data are added, then the series is stationary and conventional statistical methods are appropriate. A series of prices that grow without bound in time is not stationary, and, in this case, the mean is not constant. Even if a price series has a constant mean, if fluctuations around the mean become increasingly larger with time, the series is again not stationary: in this case, because, the variance, which is a measure of volatility, is not constant (Bacon & Kojimi 2008).”

Section IV

The Factors Influencing the Derivatives Markets

The derivatives markets in the 21st century is closely integrated with the commodities markets. This stands truer in case of the oil derivatives. There exists a whole range of factors that can influence the physical markets and hence in turn the derivative contracts. Some of the salient factors that influence the oil derivatives contracts are:

Price Volatility

Price in general defines the value which a customer is willing to pay at any time to acquire something of value. It is a known fact that the prices of oil as of any other commodity are increasingly determined by the market forces. Essentially it is the combined interaction of the demand created by the oil consuming nations and the supply furnished by the oil producing countries that decides the price of oil at a given time. In the current scenario, oil derivatives are being immensely influenced by the utterly accelerated frequency and magnitude of the changes in the oil prices. This volatility in the oil prices can be attributed to a variety of factors like the ongoing global recession and credit crunch, globalization of the markets and economies, the fast paced industrialization of the third world countries and the digitalization of the markets and the economies (Marshall & Bansal 2005). Also the attempts made by many countries to artificially restrain the domestic oil prices by disrupting the normal functioning of the market forces has added other dimension to the oil price volatility. The derivatives contracts for oil are in turn, immensely influenced by this unprecedented volatility in the oil prices. On the one side it has added an element of unpredictability to the derivatives market, but on the other side it has enhanced the relevance of the derivatives as the tools for managing oil price risks.

Globalization of Markets

Gone are the days when the problems related to oil prices and oil revenues were primarily confined to the domestic domain of the oil producing and oil consuming countries. In the contemporary globalized scenario, the oil producing and consuming countries are required to respond to the volatility of the oil prices in a global context. No nation can afford to use the risk management instruments that defy the cherished ideals of the free market economies and stand against the spirit of the international treaties and agreements governed by WTO (Marshall & Bansal 2005). The key players in the derivatives markets have to keep an eye on the developments taking place in the related factors in the foreign markets. The oil intensive corporations have globalized their procurement and production policies so as to benefit from the advantages offered by the foreign climes. This large scale global production and marketing of oil and oil products has given way to giant multinational corporations that have a major stake in the petroleum sector. The derivatives markets in the current scenario are operating in a much broader and wide spread context, that is quiet unlike the way things happened to be a few decades ago.

Technological Advances

With the recent developments in the digital software and hardware and the resulting digitalization of exchanges and trading portals, derivatives trading has entered a new era. With the modern tools at their disposal, it has become immensely easier for the analysts and the traders to derive elaborate mathematical equations aimed at exploiting the discrepancies existing between the spot and future prices (Marshall & Bansal 2005). The digitalization of the exchanges has also greatly reduced the cost of information and the cost of transactions, thereby unleashing a fierce competition in the derivatives markets.

Regulatory Changes and Enhanced Competition

The fast developing economies in the Asia and Latin America are increasingly opening up to the spirit of free market and competition and the oil sector in these economies is getting deregularized (Marshall & Bansal 2005). This has made the small operators and the derivatives traders in these economies vulnerable to a cut throat competition from the global players. This has certainly changed the dynamics of the derivatives markets and more so in the case of the oil derivatives contracts. The small players are responding to this challenge with new and innovative approaches, as they have an easy access to the data and information, courtesy the IT revolution. This has immensely added to the pace of the oil derivatives markets and has created a dire need for new models and frameworks.

Section V

Various Types of Derivatives Instruments

Derivatives – “A derivative (or a derivative security) is a financial instrument whose value depends on the values of other, more basic underlying variables (Hull 2001).”

Over the time, derivatives have emerged as major mark oriented instruments for managing unpredictability and vulnerability in the era of volatile oil prices. The four basic types of derivative instruments are forwards, futures, options and swaps.

Forward – “A forward contract is a simple customized contract between two parties to buy or sell an asset at a certain time in the future for a certain price. Unlike future contracts, they are not traded on an exchange, rather traded in the over-the-counter market, usually between two financial institutions or between a financial institution and one of its clients (Kolb 1997)”. The oil refineries and oil intensive corporations de choose to cover the future price rise by investing in the forwards, thereby locking a possible loss due to a future appreciation of price. The corporations also tend to cover their current purchase and storage costs by investing in the oil forwards.

Futures – “A future contract is similar in intent to a forwards contract, but has some important differences. A future contract has standard terms and is traded on the organized exchanges. Although the contract can be settled at expiration in the physical commodity, it is more normally settled in cash through the exchange (Pirog 2003).”

Options – “An options contract gives the owner the right, but not the obligation, to buy or sell the quantities of the underlying asset at a fixed price known as the strike price. The two basic options are calls and puts. A call gives the owner the right to buy the underlying asset at the contract price, while a put gives the owner the right to sell the underlying asset at the contract price. An option contract will only be exercised if it is in the financial interest of the owner, and is allowed to expire if it is not (Pirog 2003).” Thus an option is a less risk driven strategy then the futures as it gives the owner a chance to escape the negative outcomes of a deal. Considering this advantage, the option based strategies do happen to be costlier then the future based strategies.

Swaps – “A swap contract allows the two parties to the agreement to exchange streams of returns derived from underlying assets. Ownership rights, if any, remain intact and the physical asset is not exchanged. Settlement payments are made in cash at the predetermined points during the life of the agreement to balance out differences in the value of the swapped return streams (Pirog 2003).”

Section VI

Hedging with Forwards, Futures, Options and Swaps

The oil producing and consuming countries can resort to hedging by using derivatives instruments like forwards, futures, options and swaps. The primary purpose behind hedging is to reduce risks and to transfer risks accruing due to volatile oil prices. For example, a country or a company that expects to sell a quantity of oil in the future can decide to go for a short hedge by opting for a short future position. Now if the price of the oil goes down, the involved party though stands to loose on the sale of the oil will certainly end up making gains on its short term standing. Similarly a country or a company that decides to buy a certain quantity of the oil in the future can resort to a long hedge by choosing a long future position. Thus, if the price of oil rises, the party will definitely incur losses on the purchase of the oil, but these losses will be diluted by the gains made on its long term standing. Therefore, hedging qualifies to be an important instrument that is at the disposal of the oil producing, and the oil consuming countries, which can be resorted to, to manage oil price risks.

The usability of hedging as a risk management tool depends on a variety of factors, which are:

- The extent and magnitude of the risk which a country or a company is facing in the oil market. This mostly depends on a range of factors such as the current volatility of the oil prices, the correlation existing between the spot price and the future price of oil, the pressure being faced by a party in the realm of its monetary and fiscal policy, etc (Bacon & Kojimi 2008).

- The magnitude of the risk, which a country or a company expects to transfer or avoid by resorting to hedging. If the concerned party is under the perception that it faces a risk of very high magnitude in the oil market, it can certainly dilute the expected losses by opting for hedging using the varied derivatives instruments (Bacon & Kojimi 2008).

- The expected cost of hedging that a country or a company expects to bear with. If the cost associated with a hedging solution is tolerable or minimal, the party definitely stands to gain in terms of security and safety by opting for a hedging position. On the contrary, if the expected cost of hedging is high, the party will certainly feel discouraged and will try its best to avoid it (Bacon & Kojimi 2008).

- The expected benefits of the possible risk reduction in the short or long term as compared to the cost of hedging. Under certain circumstances, a country may feel that reducing risks by hedging favors it immensely in other aspects, be it political or psychological, it may decide in the favour of hedging even if the cost of hedging is decidedly high (Bacon & Kojimi 2008).

Section VII

Conclusion

This analysis of the oil price volatility and the derivatives markets leads to a number of valid conclusions. Going by the trends prevalent in the oil market marked by expanding demand stimulated by the exponential industrialization and growth in the developed world and the ongoing recession, the immensely rigid oil supply further constrained by the proposed production cuts by the OPEC and the alternations in the inventory management practices of the oil refineries and the oil companies, the current volatility in the oil prices is expected to be a permanent feature.

Though many interest groups intend to suggest that derivatives activity is further contributing to the volatile prices, there exists no credible evidence to support such claims. In contrast, the derivatives markets have a close correlation with the physical markets, and both are influenced and affected by the market fundamentals of demand and supply. Besides, the derivatives markets have evolved over time and are more open, transparent and organized. There exist varied mathematical models and statistical tools that can help in reasonably assessing the volatility of the oil prices and their impact on the derivatives instruments.

To meet the challenges posed by the oil price volatility, the impacted countries can definitely use the hedging with derivatives instruments in tandem with other stabilizing options like diversification and stabilization funds to manage oil price risks.

Section VII

Recommendations

The following recommendations definitely deserve attention in the light of the above analysis:

- The international community should take steps to make the derivatives markets more open, transparent and organized.

- Statutory bodies should be set up to keep an eye on the derivatives markets and any type of impropriety in the derivatives markets should be strictly discouraged.

- The countries should stop resorting to the interventionist methods of managing oil price risks. Such steps tend to negatively influence the growth and fiscal stability of the concerned nations and are not in agreement with their commitments to WTO.

- Preference should be given to the market oriented instruments of risk management like the derivatives that are in tandem with the current global trends and are more conducive for the world economy and the individual nations.

- The developed countries in general and the developing countries in particular should use hedging in tandem with the traditional methods of risk management like insurance, diversification and the establishment of stabilization funds to manage oil price risks.

- The nations should take measures to institutionalize the derivatives oriented risk management by establishing hedging committees and boards, which should have the necessary power and the expertise to manage the hedging activities. Such steps will not only bring fiscal and political stability to the concerned nations, but will snub any expected corruption or impropriety.

Bibliography

- Bacon, Robert and Kojimi, Masami 2008, Coping with Oil price Volatility, Energy Sector Management Assistance Program, The International Bank for Reconstruction and Development, Washington.

- “Bank Slashes Asia Growth Forecast”, 31 March 2009, Aljazeera. Viewed 18 April 2009, <http://www.highbeam.com>.

- “Crude Price Volatility to Prevail, High Prices in the Future”, 15 January 2009, Asia Plus News, HighBeam Research, viewed 17 April 2009, <http://www.highbeam.com>.

- Dominguez, K.M., Strong, J.S. and Weiner, R.J. 1989, Oil and Money: Coping with Price Rise through Financial Markets, Harvard International Energy Studies, Energy and Environmental Policy Centre, Harvard University.

- “Energy Markets: Factors Contributing to Higher Gasoline Prices”, 2006, GAO, GAO-06-412T, Washington D.C.

- Bassam, Fattouh 2005, “The Causes of Crude Oil Price Volatility”, Middle East Economic Survey, Vol. XLVIII, No. 13.

- “Global Oil Market Review”, 2009, UAE Oil & Gas Report, Q2 2009, pp.17-24.

- Hull, John C. 2001, Options, Futures and other Derivatives, Pearson Education, Toronto.

- International Energy Outlook, 2000, World Oil Consumption by Region, 1970-2020, viewed 18 April 2009, <http://www.eia.dve.gov/oiaf/archive/ieo00/images/figure_31.jpg>.

- International Energy Outlook, 2000, Increments in Oil Consumption by Region, 1997-2020, viewed 18 April 2009. <http://www.eia.dve.gov /oiaf/archive/ieo00/images/figure_32.jpg>.

- James, J 2003, Energy Price Risk, Palgrave Macmillan, New York.

- Kolb, Robert W. 1997, Understanding Futures Markets, Prentice-Hall, New York.

- Lokare, S.M. 2007, “Commodity Derivatives and Price Risk Management: An Empirical Anecdote from India”, Reserve Bank of India Occasional Paper, Vol. 28, No. 2.

- Mabro, R 2001 “Does Oil Price Volatility Matter?” Oxford Energy Comment, Oxford: Oxford Institute for Energy Studies.

- Neil, King Jr. 2008, “OPEC Flexes its Cartel Muscle”, Wall Street Journal, Vol. 252, Issue 142, pp. 27-39.

- Pindyck, R 2001, “Volatility and Commodity Price Dynamics”, MIT Centre for Energy and Environmental Policy Working Paper.

- Pirog, Robert L. 2003, “Derivatives, Risk Management and Policy in the Energy Markets”, Congressional Research Service, The Library of Congress, viewed 20 April 2009 <http://www.policyarchive.org /bitstream/handle/10207/1728/RL31923_20030516.pdf>.

- Regnier, Eva 2007, “Oil and Energy Price Volatility”, Energy Economics, Vol. 29, pp. 405-27.

- Sharma, Namit 1998, “Forecasting Oil Price Volatility”, Thesis for Master of Arts in Economics, Virginia Polytechnic Institute and State University, Falls Church.

- World Oil Markets, International Energy Outlook 2000, viewed 18 April 2009, http://www.eia.doe.gov/oiaf/archive/ieo00/oil.html>. “Washington Perspective” 2004, National Petroleum News, Vol. 96, no. 5, 12-13.

- WTRG Economics 2007, OPEC Oil Production in 1973-2007, viewed 18 April 2009, <http://www.wtrg.com/prices.htm>.

- Williams, Orice M. 2007, Preliminary Views on Energy Derivatives Trading and CFTC Oversight, Testimony before the Subcommittee on General Farm Commodities and Risk Management Committee on Agriculture, House of Representatives, United States Government Accountability Office, GAO-07-1095T.